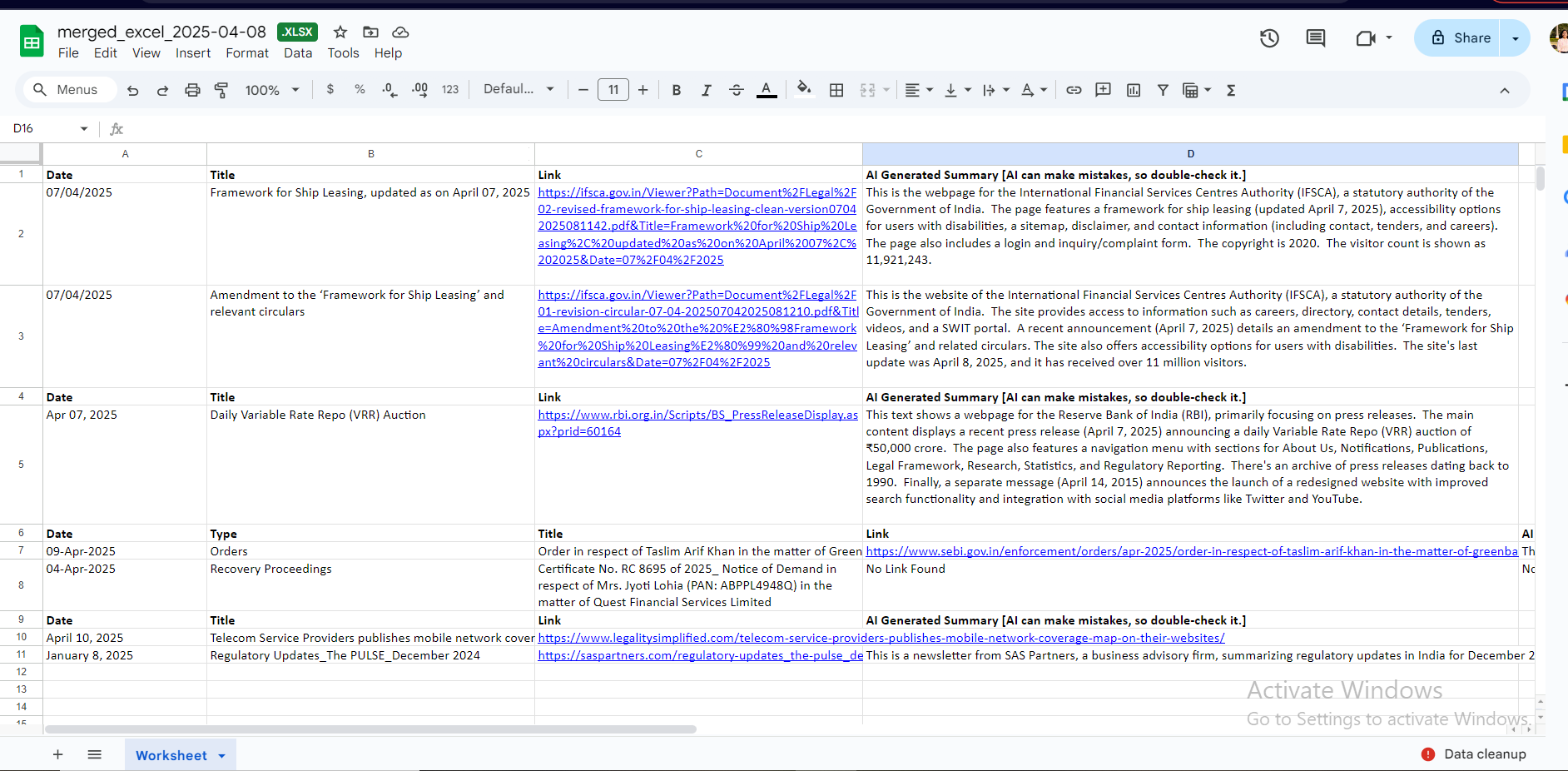

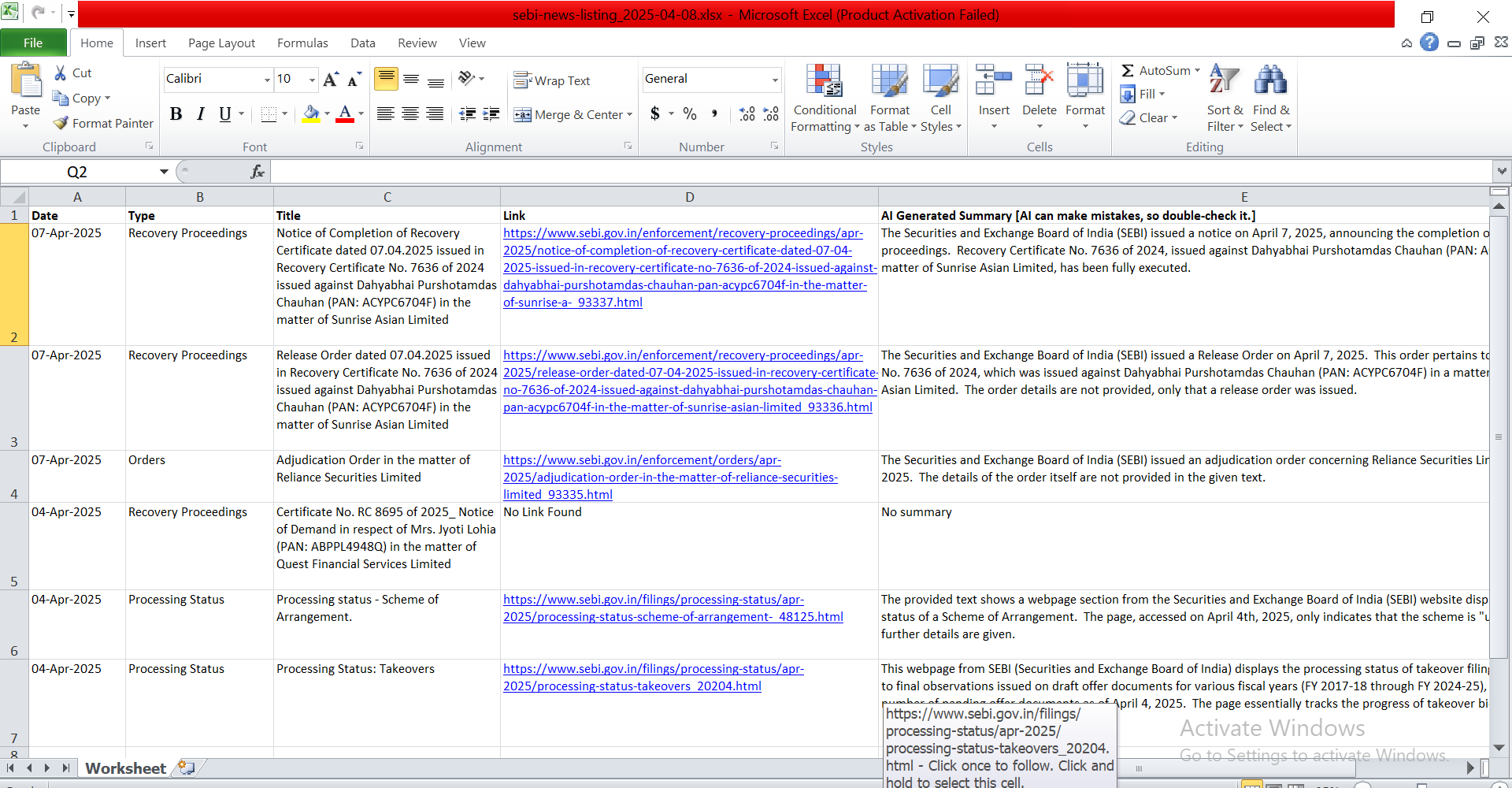

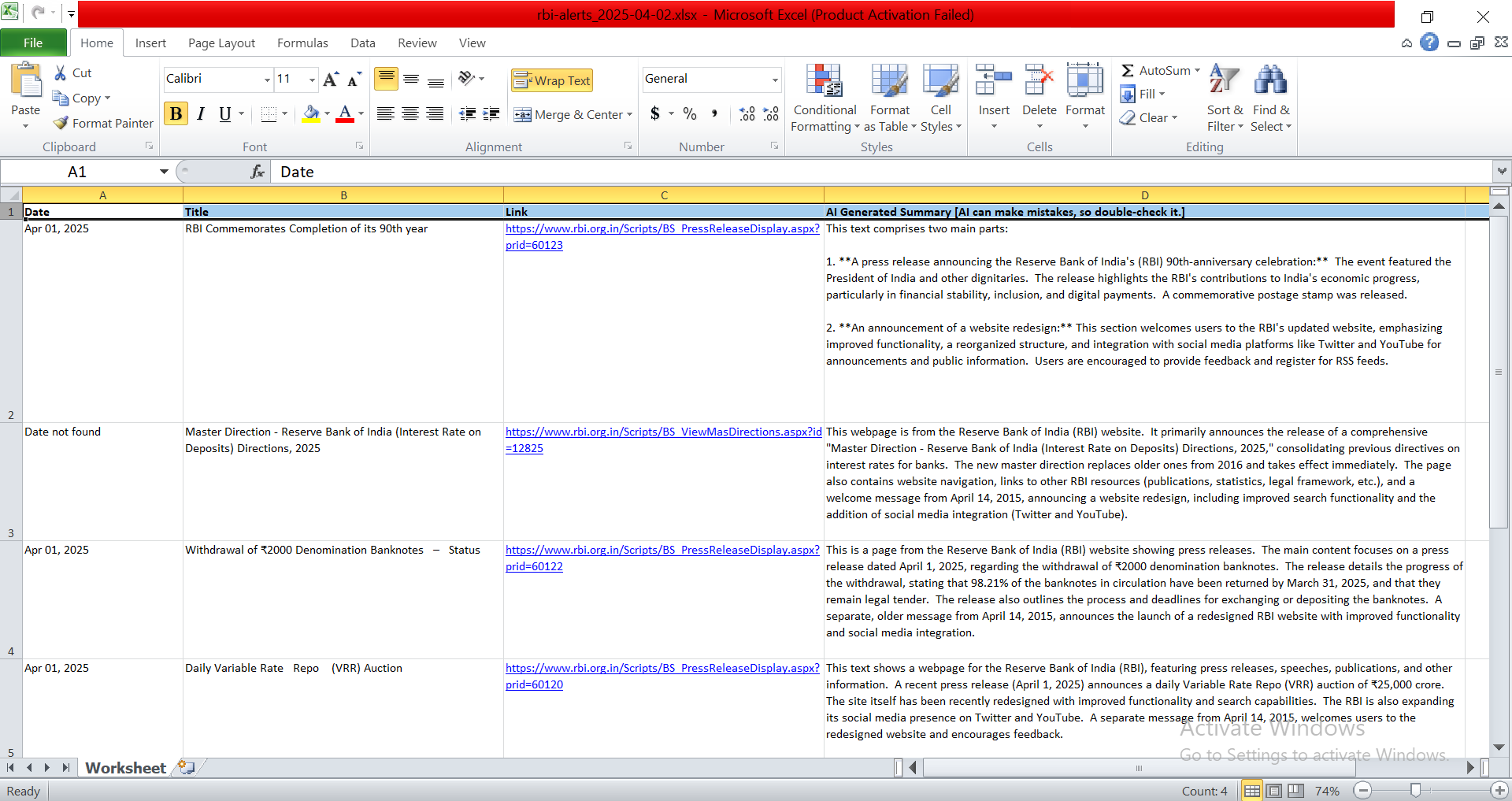

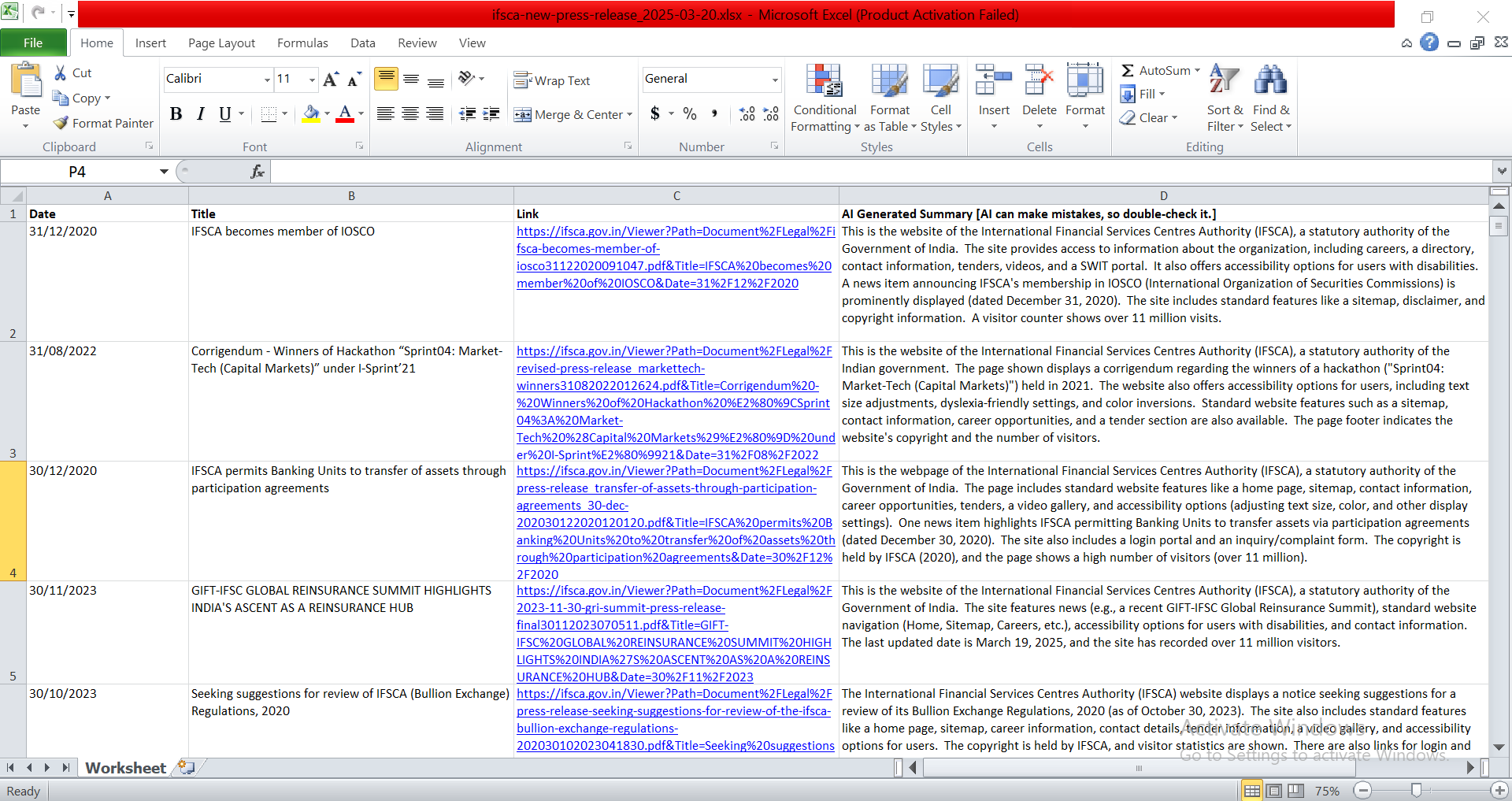

Stay Updated with the Latest from SEBI, RBI, IFSCA & More

Welcome to your one-stop destination for timely updates from top financial and regulatory authorities in India.

We track and deliver:

- New Circulars

- Press Releases

- Regulatory Announcements

- Important Notifications

Be it SEBI, RBI, IFSCA, or other key financial institutions — we ensure you never miss a beat.